Did you see the memo about this?

Today is a holiday in the States, but I still wanted to share some of the best things I read last week. I’ll be skipping much of the rest of the normal sections in my posts. Honestly, coming off vacation last week, I didn’t pay much attention to what happened in markets last week anyway.

Earnings Watch

As we’re basically done with Q1 earnings, I thought it would be good to take a look at how things went using Refinitiv’s Starmine SmartEstimate. I took the Russell 3000 names with three or more analysts whose last fiscal quarter ended in February, March, and April. Here are some of the stats. The Surprise column is beat or miss on the Starmine Preferred Earnings field. This mainly is EPS, but helps with REITs and others that don’t use EPS as their main item. The Price change is the reaction on first trade post reporting in a matching direction. Then we see that in percentage terms. So only 56% of the names that beat traded up on the first trade. Next we have the Starmine +/- 2% Predicted Surprise going into the report. 2% is statistically significant in the research. Only 35% of names this quarter predicted this. The next set of columns looks at of those 2% names, which names moved in that direction on first trade. Just under 50% for all 800+ names. The EPS directional match was closer to 62%, which is just a tad below the historical average. I found it interesting that positive names matched at almost 80%. Finally the EPS and price match looks at names that beat the Street estimates and reacted in the same price direction. You can see this didn’t go so well this quarter with under 40% performing as expected.Best of the Week

Jason and Corey discussed an excellent piece on liquidity and volatility from Wellington. There are three levels to the links below. First is the Pirates of Finance video, where they walk through the data shared in the report and give some opinions. The next level is the FinTwit conversation around this report, which Corey references in the video, that goes a litter deeper with some skepticism. Finally, the full report from Wellington is below that. This discussion is really at the heart of US equity markets today. Regulation changed the structure and way markets react to volatility changed as a result. You can get everything you need by watching the video, but if you want more, the links are there.Will fragile markets shatter? - Watch time: 21 minutes

Why fragility is the new reality for the stock market

Best of the Rest

I am a complete index geek. When I started in this industry, at the height of the Dotcom era, my desk traded the index changes for the NASDAQ 100 trust and the S&P Midcap. From there, I covered a ton of quant and index clients, and then worked as a passive index PM for a bit. So I’ve always followed index investing and trading around their changes. The team at Research Affiliates did some excellent research on additions and deletions to the S&P 500 index. They came to the conclusion that they follow a dependable pattern following the event. For the next 12 months additions underperform and deletions outperform the index. They took a look at TSLAs recent add and the AIV deletion. Their study takes a look at all the changes from 2001 to 2020. Last post, we were in the middle of the Russell Recon and now we’re a full week out. I took a look at how the additions and deletions performed versus one another. You can see that this would have been another good trade over the last month.Revisiting Tesla’s Addition to the S&P 500: What’s the Cost, Before and After?

A Pillar of Modern Finance Turns 50

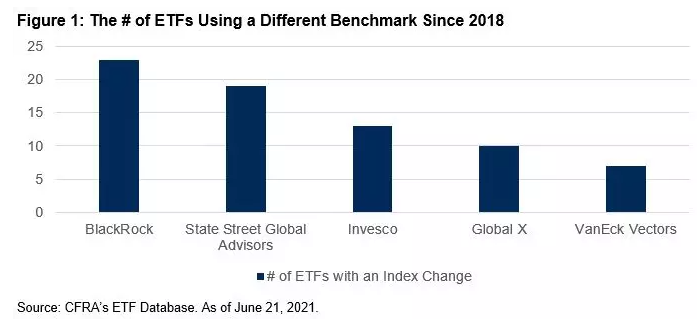

Is Your ETF Using a New Rule Book?

Active vs Passive debate on Twitter

Brad Loncar - Investing in Biotech, Chinese Biopharma & The Immunocology ETF - Listening time: 76 minutes

Why Aren’t Interest Rates Higher?

For a lover of the economic history of America, this is a must listen. A great conversation of Bhu’s new book around the origins of the United States from a business / economic perspective. They go back all the way to the funding of Columbus and the Mayflower and why venture capital is called such. This book just jumped up my 'to read/to listen' list. The biggest point he makes about early America is that religious freedom is not really the sole reason for the move across the pond. I also found it amazing that the business giants of the 19th century, Rockefeller, Carnegie, Vanderbilt, all came from modest backgrounds. Bhu and Meb finish up with talking about EVs, China, and how things possibly play out from here.Bhu Srinivasan, Author, Americana, “Is The Entrepreneur More Important Or Is The Movement And Moment More Important?” - Listening time: 74 minutes

Paris gets new JPMorgan trading hub in post-Brexit push

One for the Road

The vast majority of my readers are based in the United States, so as we celebrate our day of Independence this weekend, I thought this article from Josh Brown was an a good share for this section. Haym Solomon is not a well know historical figure. Heck, I’ve read dozens of books about this period and I did’t recognize his name. Solomon is a great example of the American story. He was a Polish Jew that arrived in the country poor and used he smarts to gain wealth, only to lose it and have to earn it back again.

Comments

Post a Comment