Things That Make You Go Boom

According to the Owlcation site, Chlorine Trifluoride is the number two most dangerous chemical known to man. Why did I choose the number vs. the number one. Well, man has actually tried to use this. It was discovered by Nazi scientists during WWII and they found it too unstable. The US tried to use it, but it spilled and melted concrete and created a hole a few feet deep. It’s basically the most explosive thing on the planet. It will set fire to basically anything it touches. So why am I going down this chemistry rabbit hole, well it rained almost the entire weekend, but also because we saw one of the deadliest trades come into play again last week. There are a couple of examples, but this widow maker trade, natural gas futures reared its ugly head again.It famously put Amaranth Advisors out of business. Volatility was the story across many markets last week. Equities, Treasuries, Crypto but energy and natural gas was wackiest of all. I’ll touch on this further below. Friday’s jobs number was a dud on Friday. Coming in at 194k vs. the expected 500k. Earlier in the week, we saw the debt ceiling debate pushed all the way out to December.

The big story coming into the week will be earnings. I’m also tracking what comes out of the FDA panel on recommending booster shots for Moderna and J&J. Penn Gaming shareholders will vote on the $2B proposed acquisition of Score Media.

Earnings Watch

Last Week

The last truly light week for earnings was last week. So there was a bit of focus around those reporting. Pepsi, which was the largest reporting, had a nice surprise to the upside on both the top and bottom line and the stock had decent performance into the end of the week. The best performer of the week was Acuity Brands. The company beat on the bottom line by nearly 15% and traded up 15% to end the week. Duckhorn, which I mentioned last week, had some unusual performance. It beat on both the top and bottom line pretty handily and saw a bunch of upgrades, but after a strong first trade +6.3%, the stock traded off immediately and ended the day down more than 8%. There was limited news aside from some insider selling. On a side note, their Napa Chardonnay is a solid mass produced wine. The worst performer of last week was Lamb Weston Holdings. LW is a food processor. If you’ve ever had Alexia brand frozen potatoes then you know LW. They had a small miss on the top line, but a bad one on EPS. The stock was punished, but it didn’t trade all that much volume. That was one trend I noticed from almost every name last week, low relative volume.This Week

The tip of the spear for Q3 reports starts this week with the mega banks. Their size gives us some weight, so 6% of the Russell 1000 market cap reports. Everyone is watching the banks for their comments on lending and rates, but I love to hear from Capital Markets. Banking has been helping Trading drive this bus for the last few quarters, and that should continue. Refinitiv’s head of Banking and Capital Markets, Cornelia Andersson, joined Roger Hirst to discuss the record M&A volumes driving that. Outside of the banks, I’m looking forward to hearing from Alcoa. Once the name that officially started Earnings Season, it’s now just a name. Though, it’s got a nice 4.9% Predicted Surprise with some decent momentum in it’s estimates. There’s also a positive bold estimate from Morgan Stanley’s five-star analyst, Carlos De Alba. I want to see if the S&P 500 names can beat the IBES estimated overall earnings’ growth numbers, which stand at 29.6%. Big growth is expected from Energy and Materials and Consumer sectors are the lowest when excluding Utilities.Equity Capital Market (via Refinitiv’s IFR)

The thing I was following in last week’s capital markets was the postponed listing of $600M iFIT Health & Fitness. There were some questionable activities and valuation in the news. The deals that did go through didn’t add up to much. Only $2B in total value in the US markets, the largest being Life Time Group Holdings at about $700M. Next week is looking light again. IFR has five IPOs with proceeds of $1.9B, but the filings are still coming in. There are something like 40 deals in the “active” IPO log, so the cupboard isn’t bear yet.Best of the Week

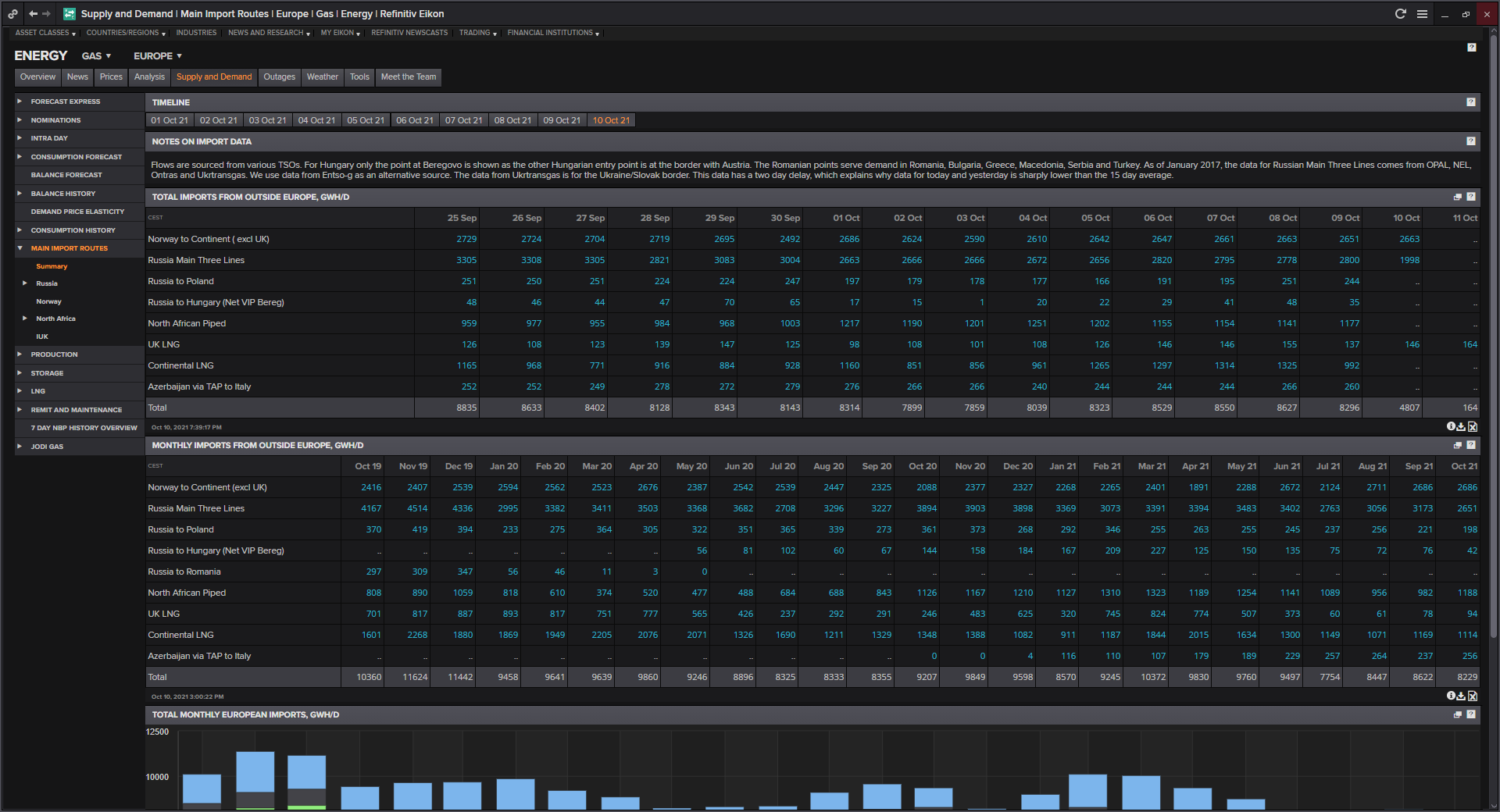

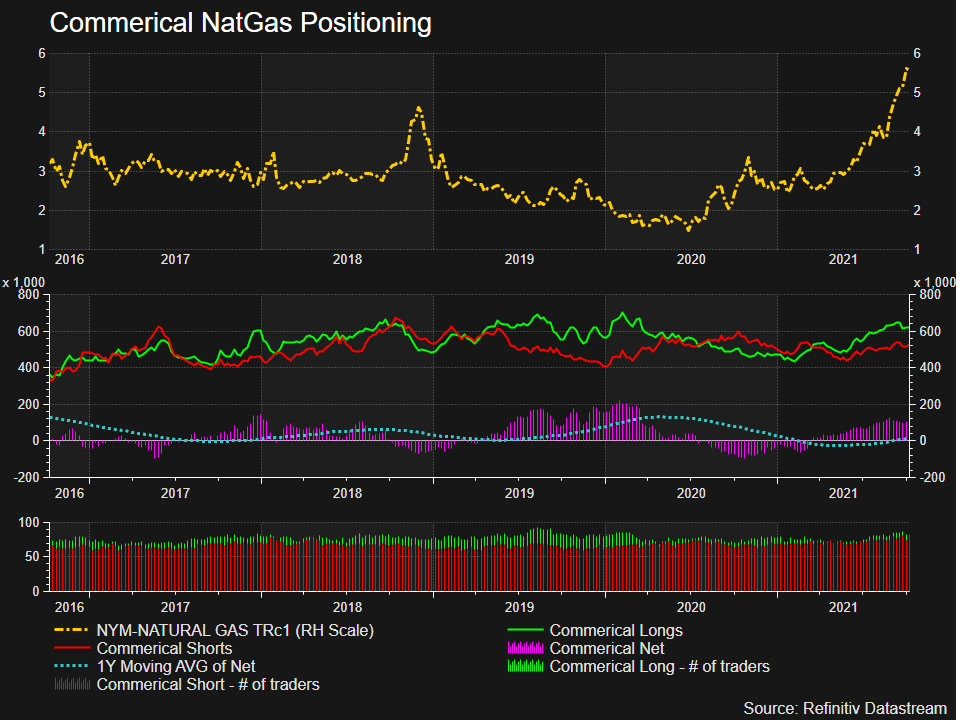

As mentioned in the open, the nat gas trade has gotten a little volatile. Kris walks us through the widowmaker trade in US Nat Gas, but this time it’ actually is different. Much of this stems from China. China has struggled to produce enough power for their country. They’ve banned imports of coal from Australia, had trouble with renewables, and have tried to be more environmentally conscious. The supply has been limited, while at the same time the country is starting to create more demand for power. This has caused knock-on effects across the globe, because they are looking for more energy from central Europe, who can deliver their resources either way. I spent much of the day Sunday reading articles trying to understand this more, but it’s a tangled web. Here are a few things that stood out to me, the amateur. First, the rise in the European region prices of gas dwarf the “slight bump” in North America. Second, as mentioned, Russia is being approached by two buyers, and from the looks of the supply and demand charts, they’re sending less gas to the European continent. As mentioned in the last article below, this is all adding to the volatility in futures and has commercial accounts getting long. I could be way off base here as this was my first dive into the fundamentals of the NatGas market.What The Widowmaker Can Teach Us About Trade Prospecting And Fool’s Gold

As Europe Faces a Cold Winter, Putin Seizes on the Leverage From Russia’s Gas Output

U.S. natgas volatility jumps to a record as prices soar worldwide

China's Power Shortfalls Begin to Ripple Around the World

Best of the Rest

The proliferation of tokenization still amazes me. So many people have always said, “I don’t know about Bitcoin, but I sure am a buyer of blockchain.” I’m not sure they saw some of these use cases. I like to continue to stay in the know on what is happening here, because eventually I think it will roll into things that matter for our everyday living, like transferring house titles. This article highlights many of the new ways people are breaking up assets and selling them off. Whether it be a rising comedian’s worth or whiskey, I do think this application is helping the upper middle class and the wealthy diversify their investments into more real assets.The fractionalization of everything

SPDR Key Charts to Help Navigate the Market - October 2021 Edition

Inside ESG: The tiny fund that took on a US giant and won - Listening time: 20 minutes

This is an old article that got bubbled up on my Twitter timeline this week, so I thought I’d share it. Edwin is a young energetic short thesis researcher. Per a number of interviews I’ve heard him on, he doesn’t hold short positions and makes money off subscriptions only. This article was written way back in February, but the topic still holds some truth today. Much of what Edwin wrote about has not changed. ARK’s current AUM is around $55B, and they still have a number of huge positions in smaller names. While Edwin’s worries look to have been a little overblown at that time, there is still that worry about the size of their holdings. I screened for the names Ark has more than 10% ownership in, excluding SPACs. There is a lot of red here on the performance side, and some really scary liquidity stats here. Things could get real ugly if investors head for the doors or some hedge fund decides it wants to play a game.

Will ARK Invest Blow Up?One for the Road

Don’t miss this one. Kara Swisher asked Elon Musk a bunch of semi-tough questions at her Code conference. It’s a little weird, because Kara almost completely lost her voice by the end of this event and was basically whispering her questions to Musk most of the time. Don’t let that take focus away from the great conversation.Thanks for reading. I hope you're on a hot streak this week.

Michael

Comments

Post a Comment