No Soup for You

Earnings Season

Last Week

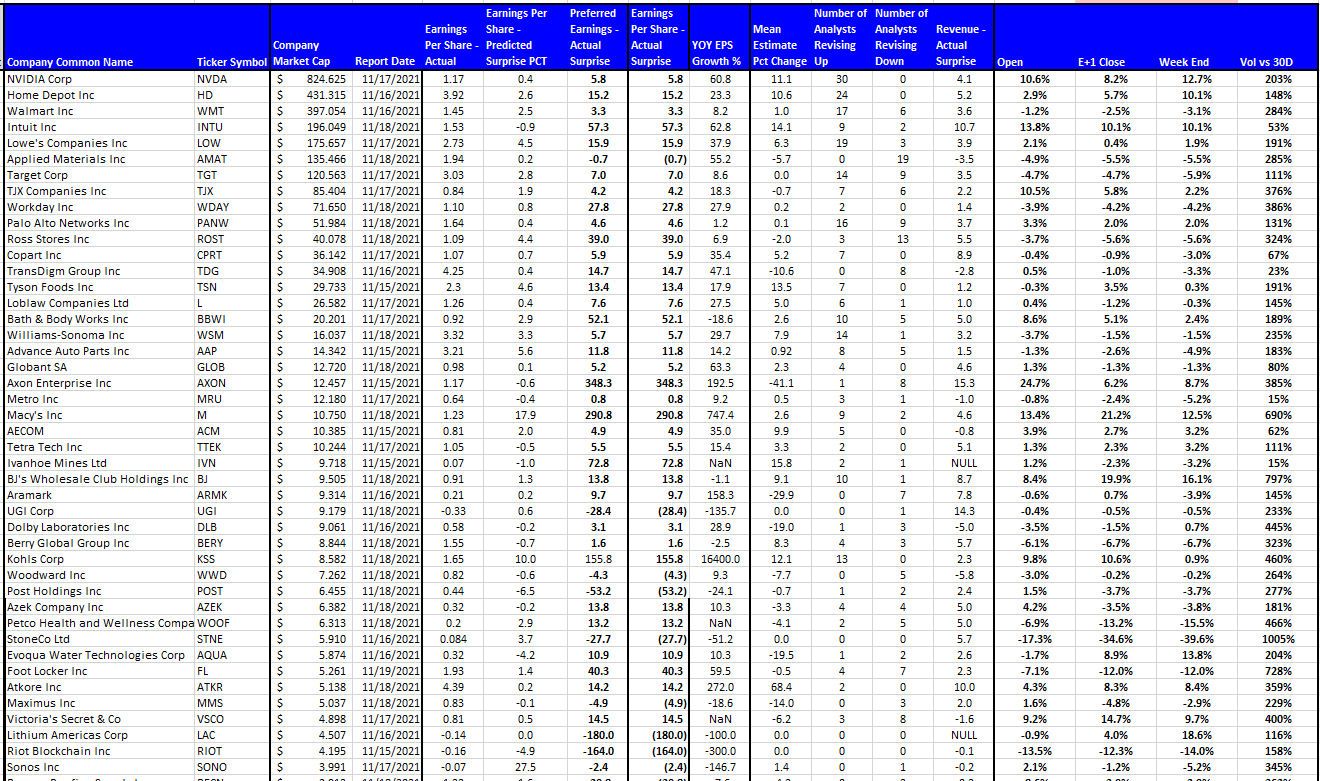

Still a bunch of names reporting as of last week. Retail was the focus, but also some big tech names. There were a few nice reports out there. Nvidia, the largest name to report, beat on the top and bottom line and ended the week up almost 13% from their report. One of my favorite names, Home Depot, surprised and traded up nicely. The big winner on the week though was Macy’s, which crushed EPS estimates and exploded to be up more than 20% on 7x average volume. It closed the week up 12.5%, off a little on profit taking. The stock is up nearly 200% this year. Other winners were Kohls, BJ’s Wholesale, Intuit, and Victoria’s Secret. Some losers on the week were TJX, Foot Locker, Riot Blockchain, Petco, and StoneCo.This Week

We have a lighter week with mostly the tails remaining, the US Thanksgiving holiday on Thursday and essentially an off day on Friday. That doesn’t mean there’s nothing going on. Deere’s report should shed some light on the employment issues in the US. Deere’s had some issues getting it’s workers under contract. It’s showing a pretty negative Predicted Surprise of -7.2% on the EPS and has some negative momentum on that estimate, which has dropped more than 10% over the last week. Other names of interest, for me, this week are Best Buy and Dick’s Sporting Goods. They both have huge positive Predicted Surprise coming into the week and unlike Deere, have positive estimate momentum.Equity Capital Markets (via Refinitiv’s IFR)

Looks like investors in the IPO space were ready to break for the holiday a week early. Only five US IPOs last week, but three performed quite well. We also had the largest of the year in Canada with Definity Financial. In the US, Kindercare postponed it’s $500 IPO. Yet another EV company came to market. Sono Group is still pre-revenue, so of course it’s got a billion dollar valuation. Sweetgreen was the best performer on it’s opening trade, but didn’t move up much after that.While it wasn’t a huge week for IPOs, that’s not the only part of the ECM world. There were more than 30 follow-ons for $12B and a huge week for Convertible Bonds with five $1B plus deals and $8.4B total. I don’t often cover convertibles because they’re more of a bond to me, but some of these that went down last week have more equity like exposure than normal. For example, Unity Software priced a $1.5B CB at zero percent coupon and a 57% premium on conversion. Affirm and Digital Ocean had similar size and premiums as well.

Best of the Week

Just an excellent write up from personal experience on what some of the problems facing the shipping industry are, from someone in the industry. Basically, there are too many choke points and no reason for the shipping companies to change.I’m A Twenty Year Truck Driver, I Will Tell You Why America’s “Shipping Crisis” Will Not End

Best of the Rest

In the article above, we heard from one person's perspective on what’s causing the issues. In this NPR podcast, we hear of a few more examples of regulation and misallocation of resources that continues to limit the possible fixes to this situation we find ourselves in.Of boats and boxes - Listening time: 23 minutes

Investors question trading of ETFs off-exchange

8 Minute Market Structure | Mike Masone - Watch time: 12 minutes

Here's The Names to Watch As Massive Options Expiration Looms

Barry Ritholtz shared this chart in one of his daily emails. Via MPG Consulting we have a look at the life cycle of an industry and where some majors sit on this timeline.

Cannabis Industry Life Cycle Stage

Almost 50% of hedge fund longs are in stocks with valuation >10x sales…

One for Road

This one is literal this week. There are a few sites that follow patents applied for by companies, and many that specifically follow the patent freaks over at Apple. Someone went ahead and created a concept car using all the patents the company has filed. Some of the patents might not actually be for an automobile, but conceptually they could be.Stunning Apple Car concept created using Apple patents

Before I let you go, here are three things I'm thankful for:

- My general health. Although I'm getting older and small things hurt more than they used to. I'm generally pretty healthy.

- The ability to work from home. I've been able to deal with a ton of issues this year from my home office. Also, the wasted hours of commuting are no more.

- Working with great colleagues. Work can be hard when you don't really like the people you work with. I don't have that issue. The team of people I interact with are amazing.

Thanks for reading. For US readers, don't eat too much Turkey.

Michael

Comments

Post a Comment