Where's the Love?

I want to open with a statement here. I can in no way attempt to know how much the events in Europe impact the people of the Ukraine and even the normal Russian citizens. We see videos on the television and read about it in reports, but I’m sure it’s even worse being there than most of us can even imagine. As I write this on Sunday, I’m hoping we can have a quick end to this and cooler heads with prevail. In the links and comments below, I will only attempt to give you some information around how these events impact financial markets and data. This is a horrible situation for any of those involved in the region. I’m sorry for them and I wish I could do more to help. It seems heartless to even be writing about things like this, when these events happen.

There are so many antiwar songs that I thought about using for my headline this week, but rather than be angry I thought the Black-Eyed Peas song would be a better representation of how I wished things would be. Where is the love?

Trying to bring us some sense of normality here. Let’s take a look at how these senseless acts of desperation impacted global markets. This week’s post will focus mainly on finding information on what is impacting global financial markets. There’s no way that I can cover all of it, but I try to give you a peek into what to pay attention to.

I thought an easier way to show the weekly performance of assets was to use Refinitiv’s DataStream to build a few charts. The charts below show some highly followed assets and a bar chart showing their change at the highs in Percentage terms for Equities, Futures and Currencies, and in yield basis points for the benchmark bonds for the 2s and 10s tenor. The star is the weekend (Friday) reading.

In looking at this, wheat stands out particularly. Russia is number three, number four if the EU is considered as one entity, according to Statistia. It was up as much as 16% this week and closed up 5.8%. Soy also had an odd turn, going from up 4.6% to close down almost 1%. Most commodities saw volailtiy on the Ukraine crisis. US Equities were down a decent amount and ended higher. Maybe thinking the Fed might not hike with war on the table, we’ll see below an argument against that below. European and Asian equities closed off their lows as well. On the bond side of things, rates rose in the US and Germany, but fell a bit in the UK and Japan on the short end. The 10Y only Japan saw yields fall though small.

Earnings Watch

Last Week

The performance this week on Earnings reports needs to be taken with a grain of salt. Anything reporting on Thursday or Friday is going to have some outside forces working on the stock reaction. Home Depot and Lowe’s had a bit of a weird dance. Home Depot reported decent numbers on Tuesday, but decent is no longer good enough for a stock outperforming the index by 20% over the last year coming into the week. Even though it’s off its highs, it was still trading with a 21 forward PE according to IBES estimates. The stock sold off and LOW did so in sympathy. Lowe’s had a much better call on Wednesday and traded up decently until US markets started selling off.

For my calls from last week, Square and Caesars were both misses. Square crushed it on the bottom line and traded up over 20%. Caesars actually missed big, but traded up a decent amount. My one full win was ETSY, which beat estimates handily and traded up about 15% and finished the week strong. This week I’ve expanded the results to show some international names of interest.

This Week

Berkshire reports this week and it’s far and away the largest name, but there are still some very large others. The Canadian Banks are on tap this week. There’s also some large tech in Broadcom, Snowflake, and Marvell. SaaS businesses too n Salesforce, Workday, and Zoom. Another large group in play will be retail names, headlined by Costco and Target. Here are a couple of names I’m following:

BJ’s Wholesale is showing a 2.3% Predicted Surprise and has shown some positive momentum since the beginning of the month. Five-star analyst, Ed Kelly, at Wells Fargo is 14% above mean and is predicting a strong beat here. Deutsche Bank’s five-star analyst recently revised higher as well.

The other name for this week comes from Canada. Canfor is in forest and wood products. One analyst at CIBC is pulling down the mean, so it’s showing a 9.7% Predicted Surprise. The EPS numbers have risen more than 30% over the last month. A slight concern is the predicted miss on the top line.

Best of the Week

There are rumors or theories that Putin and Russia have been stock piling assets since this invasion was in the early planning. Some think they’ve been buying up gold recently too. This article highlights some of the actions Putin’s regime has taken to prepare itself for the world’s reaction. Below is a look at the government debt over the last 20 years as a percentage of GDP. You can see how low it is compared to many of the developed countries. I’ve also included a few charts from Refinitiv’s DataStream chartbook around the recent impacts to other Russia markets.

Why Putin didn’t flinch in the face of an onslaught of financial sanctions

Rob Person is the Professor of International Relations at West Point. He’s a specialist on Russian and post-Soviet politics. Rob took to Twitter to share some insights on Russia’s financial situation and what impact the sanctions might have on their economy. Some of the data is well known and even shared here in the last two weeks, but sometimes he looks at it in different ways. The thread ends by Person saying that Putin knows he can’t raise Russia up to the level of its major rivals, so he will try to bring them down.

How long can Russia endure Western sanctions?

This is an in-depth report from Refinitiv’s Commodities Research team on impacts on oil markets. There is a incredible amount of data in this report. If you’re involved in oil, this is something to read. It looks at who gains from Russian sanctions and which countries are importers of Russian oil. The part I found most impactful was the question of Iran. Many of the oil from Iran is thought to be going solely to Asia, but what happens if OPEC+ adds them to the plus? Below is a chart from the report of where Russia is sending Gasoil. Also, I put a chart of the Brent/WTI spread, which has jumped a bit, but isn’t high by historical standards.

SPECIAL REPORT - oil on boil, Russia & Ukraine

Above we looked at the oil market specifically, but these charts show which countries are impacted by Russian gas. This Statista graphic led me to some excellent coverage from our partners at Reuters news on the gas markets in Europe.

Which European Countries Depend on Russian Gas?

Russian gas threat in Europe

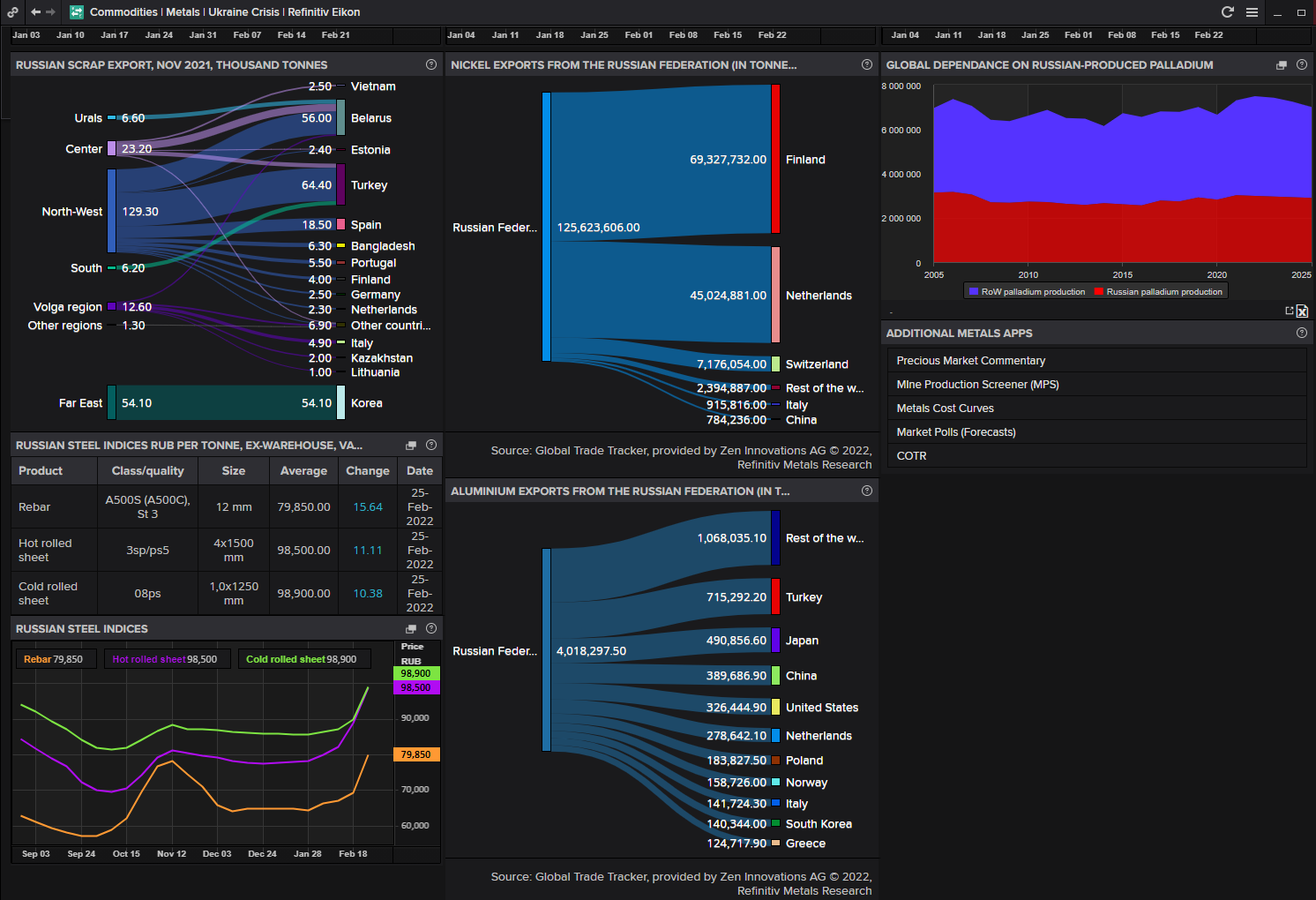

Here's another piece on what's on the line for the world economy. Its a good summary covering some areas not covered in the other articles. It also touches on the metals market, in which Russia is a major player. I took a screenshot from Refinitiv's Eikon of the Metals summary. You can see how this could cause some major issues in yet another market.

How long can Russia endure Western sanctions?

This is an in-depth report from Refinitiv’s Commodities Research team on impacts on oil markets. There is a incredible amount of data in this report. If you’re involved in oil, this is something to read. It looks at who gains from Russian sanctions and which countries are importers of Russian oil. The part I found most impactful was the question of Iran. Many of the oil from Iran is thought to be going solely to Asia, but what happens if OPEC+ adds them to the plus? Below is a chart from the report of where Russia is sending Gasoil. Also, I put a chart of the Brent/WTI spread, which has jumped a bit, but isn’t high by historical standards.

SPECIAL REPORT - oil on boil, Russia & Ukraine

Above we looked at the oil market specifically, but these charts show which countries are impacted by Russian gas. This Statista graphic led me to some excellent coverage from our partners at Reuters news on the gas markets in Europe.

Which European Countries Depend on Russian Gas?

Russian gas threat in Europe

Here's another piece on what's on the line for the world economy. Its a good summary covering some areas not covered in the other articles. It also touches on the metals market, in which Russia is a major player. I took a screenshot from Refinitiv's Eikon of the Metals summary. You can see how this could cause some major issues in yet another market.

The Capital Spectator breaks down the probabilities of how relations between Russia and the West will proceed. He sees a 20% chance things happen and return to normal quickly, a 70% chance that things deteriorate rather significantly and there are major disruptions to world trade, and a 10% chance that we have a complete and total collapse of relations into a Cold War II. BUT, as he notes there’s a chance that there’s a joker in this deck. Below is a chart of the Rouble going back far enough to see the last time Putin invaded. There was a ton of volatility even after the event. I'm sure any of his scenarios would show similar, but an 80% chance it might be much worse.

How Will Russia’s Invasion Of Ukraine Change The Risk Calculus?

As noted in the article above, Germany might be the key for Europe in many ways. Germany’s finance agency started stepping up already. They’ve been increasing their repo market activity to ease some of the dislocations. After the ECB pivot to a more hawkish stance and now the Ukraine crisis, there have been some stresses on the bond market.

German debt office acts to ease bond shortage after ECB, Ukraine crisis

You might have heard the press asking questions of the President Biden as to why they did not put more impactful sanctions on Russia to start. As of Sunday, Western allies blocked “selected” Russian banks from the SWIFT payments system. This is a pretty big measure in my opinion, but probably needed if the West wants to use a non-military response. As the second link from ‘Net Interest’ notes Russia transformed its economy to be less reliant. They built up reserves of roughly 40% of GDP versus just about 9% for other European Central Banks. Russia seems to have studied the West’s film and began prepping for more autonomy. The Reuters article notes that it created an alternative network, which handled about 20% of Russian internal messages in 2020.

Analysis: SWIFT block deals crippling blow to Russia; leaves room to tighten

Swift Sanctions

Goldman Sachs does not feel that war will impact the Fed’s decision process. They feel that inflation dominates that narrative. Economists Joseph Briggs and David Mericle stated in a note to clients that things are different this time because inflation risk is creating a more urgent reason to tighten today. I’m not so sure I agree here. Hikes? Sure, that’s a strong likelihood, but quick aggressive hikes, that’s where I get off the bus. Just two weeks ago the probability of a 50bps hike was 56.5%, now that’s been cut in half, standing at 27.5%. Below is a chart of the recent history for the chance a 50bps hike happens in the March meeting.

No, War Won’t Make the Fed Ease Off Rate Hikes, Says Goldman

A History Of Invasions, Wars & Markets

In his weekly ChartStorm, Callum Thomas shared this look at IPO activity in the US. My question in seeing this is, what does this mean for large global investment banks?

One for the Road

Frank Slootman is the Chairman and CEO of Snowflake. In this interview, he and Patrick touch on a bunch of topics related to teamwork, sales, and pretty much anything about running a business. Frank has an impeccable CV. I loved his thoughts around narrowing the focus. He mentioned that if you have too many things to focus on then you have none. My favorite topic was the idea of soliciting problems from customers rather than their ideas for solutions. I also found his description of a successful sales organization thought provoking.

Frank Slootman - Narrow the Focus, Increase the Quality - Listening time: 51 minutes

Michael

Comments

Post a Comment