Waking Up Now that September Has Ended

Well, it sure seems that, like me, the US equity markets are a fan of Green Day. After a rough September with the S&P 500 down 4.8%, NASDAQ 100 down 5.3%, and Russell 2000 down 3%, the first day of October was a rousing success. The positive results of the Merck pill seemed to help flip the switch. September is the worst month for most major global indices. I looked at 21 global indices below and about half showed their worst performing month as September. Maybe this is why Green Day wrote that song?

Falling from the stars

Drenched in my pain again

Becoming who we are

But never forgets what I lost

Wake me up when September ends

This week we’ll continue looking for more political nonsense coming out of Washington. They’re grandstanding around both the Debt Ceiling and the Infrastructure bill tied to some other non-related social plans. I’ll be waiting for the September jobs number on Friday as well as keeping an eye on the Treasury Rates. Something else that should get people excited is the GM investor event. Wedbush’s Dan Ives thinks we might see some forward looking info around their EV goals.

Earnings Watch

Last Week

I highlighted Jefferies as a possible winner this past week. They reported on Thursday afternoon and had a nice beat. The stock responded decently, up 2% on the open and basically stayed there.Other names to highlight from last week were BBBY, who had a huge miss and ended the week down more than 25%, and UNFI, who was the best performer reporting this week. UNFI beat by 46% on EPS and jumped 3% on the next open, but rose about 30% by the end of the week.

This Week

We’re still waiting for the masses, but a few of my personal favorite brands report. Pepsi is by far the largest name reporting, but I’m like Uncle Warren and prefer Coke any day of the week. The parent companies of some of my favorite products, Constellation Brands (STZ) and Duckhorn Portfolio (NAPA), report this week. Comtech Telecom (CMTL) is the only name worth looking at. The small cap name is showing an 8% Predicted Surprise, but it’s a pretty wild stock and has averaged a 15% beat on EPS with only 4 analysts covering it. The stock also has some volatility after reporting with an average absolute move of nearly 13% over it’s last 20 reports. It’s been up 24% and down 19%, so it should be fun.Equity Capital Markets (Via Refinitiv’s IFR)

It was another decent week in the ECM space. Nearly $5B in notional in the US plus another $9B out of Europe. Most deals were on the smaller side, but there were a few billion dollar plus out of the Middle East. The story of the week was the two names that didn’t even hit the ECM desk in the US. Direct listings of Amplitude (AMPL) started trading on Tuesday at a value of $5B, and then Warby Parker (WRBY) hit the market on Wednesday valued at $6.6B. We’ll enter Q4 with five IPOs scheduled for the week in both the US and Europe.Best of the Week

Daniel shares some amazing stories about the early days of investing in Emerging Markets. He tells one about a company in Russia where the owner was provided with an offer he could not refuse from friends of the Kremlin at a large discount to market value. He also talks about why good companies and countries are important in emerging markets not just good numbers. I'm always fascinated with stories of the history of early market features that everyone now takes for granted.Daniel Graña – Janus Henderson Investors Emerging Markets Equity - Listening time: 52 minutes

Best of the Rest

It’s not about what you say, it’s about what you do. I must have heard that line hundreds of times. Looks like it applies to the ECB too. This chart below from Jim Reid at Deutsche Bank shows the actions of the Fed at some key inflection points in the price of oil.Is The Price Of Oil All That Matters To Central Banks

Tech stocks were just stomped. Here’s what to watch next, according to Goldman Sachs.

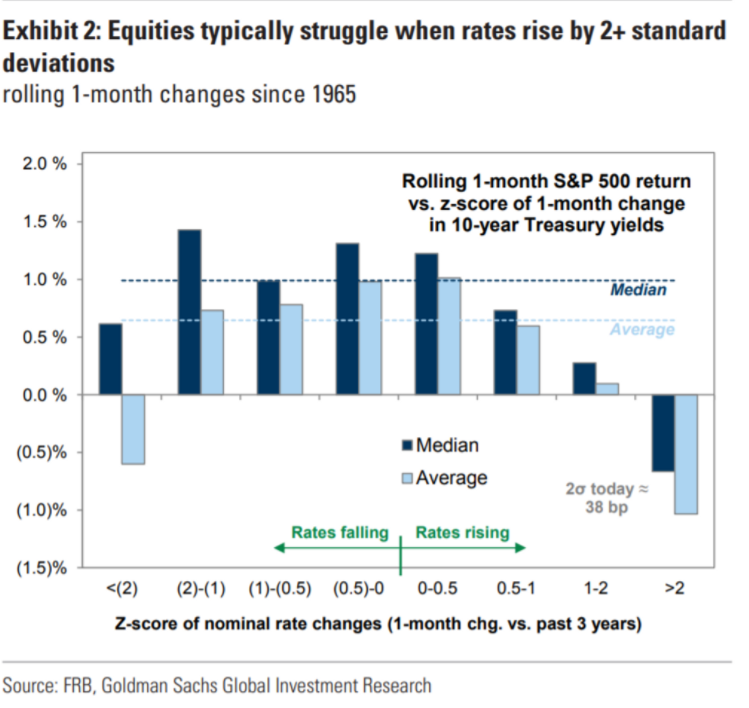

Are Rising Interest Rates Bad For Tech Stocks?

I don’t typically like to pick guests from the same podcast in back to back weeks, but Bill nailed another one. I found this interview a great follow up to some of the shipping issues over the past few months. I love to follow some of this at a high level, because the content is fascinating to me. I’ve highlighted the delays at the US ports before. Below is a chart showing the number of ships waiting to get into Long Beach (LA) ports. Just tell your wife that her anniversary present is on one of those ships. Refinitiv's Eikon also has some of the best analysis too. Like this page the analyst team built specifically to track the Coup happening in Guinea, which could have a major impact on Bauxite and in turn aluminum production in China. Everything is connected.

J Mintzmyer - Shipping Extraordinaire - Listening time: 88 minutes

Joint open letter – Transport heads call on world leaders to secure global supply chains

What is Reg NMS and could it be beneficial for Europe?

https://matttopley.com/topleys-top-10-september-28-2021/

One for the Road

Learning the ropes on how larger option trades hit the tape and how they get hedged. This is a nice shorter educational video around how things work on the desk.Thanks for reading. I hope you avoid the boulevard of broken dreams.

Michael

Comments

Post a Comment