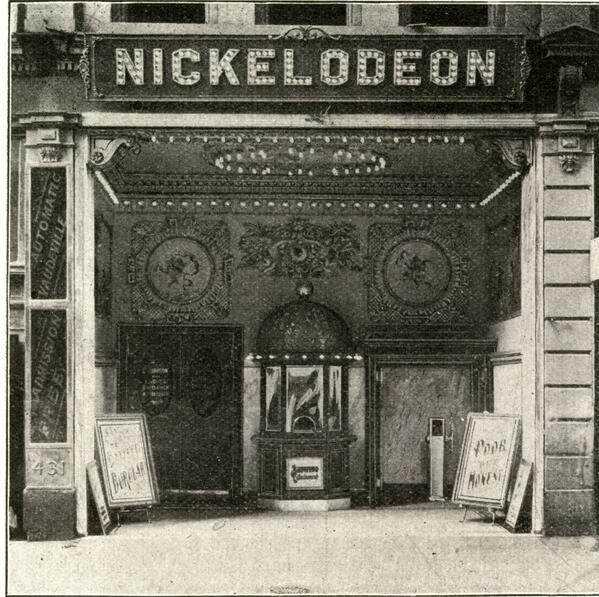

Nickelodeon

This is a big week for markets. We’re hoping for some resolution for the war in the Ukraine, but closer to home in the US, the Fed is meeting and a very probable rate hike coming. Also of note, there is north of $3T of notional options expiring on Friday. Goldman Sachs has noted that this will be the largest since 2019. Volume has shifted into index options with more than $2T of that total in SPX linked products. On top of all this, liquidity in the SPX future hasn’t been all that impressive. The implied 1-month volatility has been on the rise and is inline with the trailing 1-month measure. Looking at the 25 delta risk reversal we can see that puts are getting bid here too. The skew of SPX options isn't that large, but it has been trending more so that way.

Earnings Watch

Last Week

Earnings were a bit of an anomaly this week. It was like trying to play a 2 on 1 as a defender. You’re not sure where to focus. Macro events or the micro of earnings. I had 293 names reporting this week with a Market Cap over $2B. 61% beat on the top line and 51% beat on the bottom line, but 47% beat on both. After reporting, 57% opened higher, but 46% ended the week in the green. Looking at the names I highlighted last week. Xpeng estimates were moved to the 28th of March, our estimated date was off. The other two were good calls. Both Adidas and Rivian end the week lower. Adidas did beat on EPS and slight miss on Revenues. The stock opened higher, but traded off. Rivian didn’t even come close and ended up selling off about 7% on decent volume. I’ve highlighted some of the good, CrowdStrike and Mongo, and the bad in JD.com, DocuSign, and Asana for the week.This Week

As the volume of reports winds down in the US, some international names are starting to grab some of my attention. The big names in the US this week are Accenture, FedEx, and Dollar General. I don’t see much in the data coming into the reports. This week I’ve shifted my focus to a name in Europe and another down in Brazil. Volkswagen reports Tuesday. The company has a -7.5% Predicted Surprise and it’s seen a drop in the SmartEstimate over the past 30 days of 10%. The big difference here is the 130 day old estimate from Bernstein that was dropped. That one estimate is 30% above the mean. Looking to the southern hemisphere, I found the negative outlook for Centrais Eletricas Brasileiras, which reports on Monday. The Predicted Surprise is -29.4%, which again is due to old estimates. The company only has 4 analyst estimates and two of the four are older than 200 days.Best of the Week

This is an interesting connection. The author lays out how the American south was the world’s largest producer of cotton, which was and is an important input for textiles. The Confederacy, like Russia, thought control over this would keep military or financial threats at bay. Russia supplied 55% of gas and 45% of oil to Germany, the largest economy in Europe and world’s 4th largest. Whereas the South produced 75% of the world’s cotton. The South thought that the jobs its product provided for the mill works in the north and other industrialized nations would make war unlikely. Both Russia and the Confederate South underestimated the support the opposition governments would receive from the people. They thought the war would be quick even after they started. The South was then cut off from the world and unable to trade. Many think that even if Russian troops take Kyiv, being cut off from the world will intensify the suffering of Russian citizens. The author thinks the West should be aware of this and impose a total ban of Russian energy.Russian Oil = Confederate Cotton

Best of the Rest

Another excellent episode. I recommend this one on YouTube, so you can see the charts in the Talking Charts segment. The chat with Harris, aka Kuppy, is a tremendous one. He refers to some of the knock on effects of the oil sanctions and how the squeeze might impact all the hedging that is done throughout multiple layers. He then questions who’s left holding the bag. The guys also discuss what might happen in nickel too. They think it seeps into the wider financial markets, because the numbers are so large. They think the nickel losses alone look like they could be something like $5-20B. Definitely worth your time here.There Are No Mulligans In Trading - Listening time: 100 minutes

Chinese nickel giant Tsingshan said to have sufficient inventory for delivery

Hedge fund titan Clifford Asness leads trader fury after LME cancels $4bn in nickel trades

How Much Is a Nickel Coin Worth? More Than a Dime, Thanks to a Surge in Metals Prices

Investment giant Pimco risks losing up to $2.6 billion if Russia defaults on its debt: report

Russian distressed bonds could be scooped up, some touting deep discounts on loans

As I mentioned on my visit with the Real Vision team, the Fed is in a difficult position. They’re vastly behind the curve on slowing down inflation, and now they have geopolitical events that are causing all sorts of price dislocations. This article from James highlighted just how far of a disconnection there is between US 10 year rates and CPI. This is a 60 year relationship with over 700 observations. The current mark, as James suggests, dramatically under prices inflation. James also noted that the other answer to this is the market is pricing in a lowering of inflation. Looking at the history of CPI, you can see that it's not all that high in relative terms, but when you show that relationship that James highlights you can see how out of place it is. I also took a look at how the US CPI and 5Y5Y Break-evens look when compared to the UK and EU.

Fed Policy Is Wedged Between The Rock And The Hard Place

Intel is shaking the Bitcoin mining market, flipping the industry on its head

One for the Road

Stepping away from finance for a bit, I was amazed when I read this. Ernest Shackleton was a great British explorer who set out to traverse Antarctica in 1914. His crew was 27 men aboard two ships. Their idea was to try two routes across the continent. The main ship, the Endurance, became trapped in ice and the ice eventually began to crush the ship. It sank in November of 1915 into the Weddell Sea. Through an incredible journey Shackleton and the entire crew survived, which you can read about in one of the best books I’ve ever read, also named Endurance. The point of this link though is that more than 100 years after the voyage the ship has been found and it’s actually in amazing shape. I can’t wait for this documentary to come out.Ernest Shackleton's ship Endurance, lost since 1915, is found off Antarctica

Thanks for reading. I hope you can endure the crazy week.

Michael

Comments

Post a Comment